Introduction to Unsecured and Secured Loans

When it comes to borrowing money, understanding your options is crucial. With financial needs varying from person to person, knowing whether an unsecured or secured loan suits you best can make a significant difference. Unsecured loans offer the allure of no collateral, while secured loans come with the backing of assets. But which path should you choose? This decision could impact your finances for years to come. Let’s dig deeper into these two types of loans and help you find the right fit for your situation!

Understanding the Difference Between Unsecured and Secured Loans

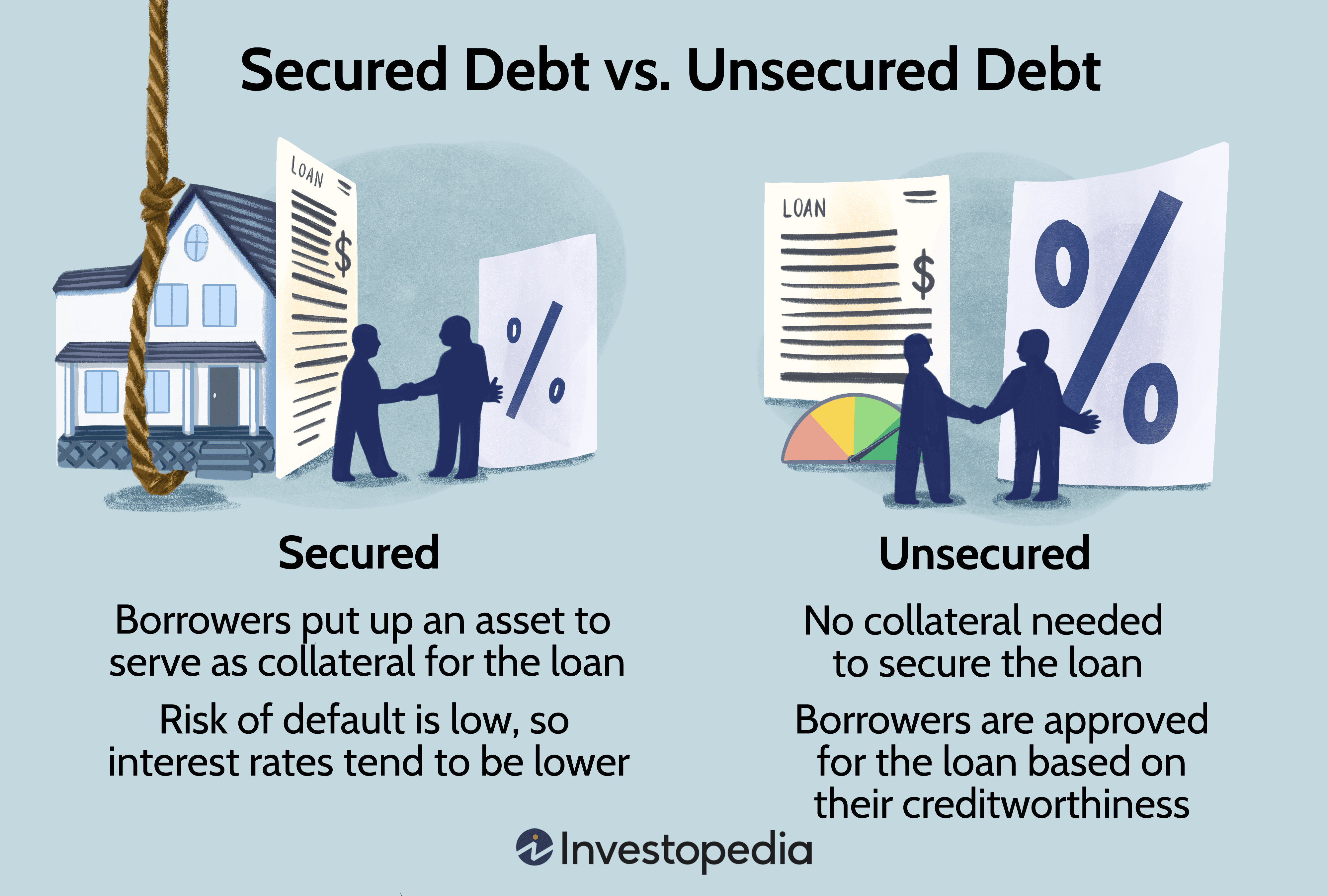

When exploring financing options, it’s essential to grasp the distinction between unsecured and secured loans.

Unsecured loans do not require collateral. This means you won’t need to put up assets like your home or car as a guarantee. Lenders base their decision primarily on your creditworthiness and income.

Secured loans, on the other hand, involve collateral. If you borrow money against an asset—like a house or vehicle—you risk losing that property if you default on payments. These loans typically offer lower interest rates due to reduced lender risk.

Understanding these differences can greatly impact your financial strategy. Choosing the right type of loan hinges on personal circumstances and comfort with potential risks involved in borrowing funds.

Pros and Cons of Unsecured Loans

Unsecured loans come with their own set of advantages and drawbacks. One major benefit is that they don’t require collateral, meaning you won’t risk losing assets like your home or car if you fail to repay.

They are often quicker to obtain because the application process is simpler. Lenders primarily focus on your credit score and financial history rather than requiring extensive documentation of your personal property.

However, unsecured loans can have higher interest rates compared to secured options. This means you’ll pay more over time, especially if you don’t qualify for the best rates due to lower credit scores.

Additionally, approval amounts may be limited. If you’re looking for substantial funding, an unsecured loan might not meet your needs as well as a secured loan could. The risks and rewards vary based on individual circumstances and financial goals.

Pros and Cons of Secured Loans

Secured loans come with distinct advantages. One of the biggest benefits is lower interest rates. Since these loans are backed by collateral, lenders feel more secure and often pass those savings on to borrowers.

Another significant perk is that you may have access to larger loan amounts. This can be particularly helpful for major purchases like a home or car.

However, there are notable downsides. The most pressing risk involves losing your collateral if you default on the loan. This could mean parting ways with valuable assets like your house or vehicle.

Additionally, secured loans often require extensive paperwork and a lengthy approval process. Borrowers must also consider their ability to repay before committing to this type of financing, as it can lead to financial strain if not managed wisely.

Factors to Consider When Choosing Between Unsecured and Secured Loans

Choosing between unsecured and secured loans involves several important factors. Begin by assessing your financial needs. If you require a substantial amount, secured loans might be more suitable because they typically offer higher limits.

Next, consider your credit score. Unsecured loans often depend heavily on your creditworthiness. A strong credit score can help you secure better rates without collateral.

Think about the risks involved too. Secured loans put your assets at stake, while unsecured ones don’t carry that risk but may have higher interest rates.

Also, evaluate how quickly you need the funds. Unsecured loans usually provide faster access to cash than their secured counterparts.

Reflect on repayment terms and flexibility offered by lenders in both categories to find an option that aligns with your financial strategy and comfort level.

How to Apply for an Unsecured or Secured Loan

Applying for an unsecured or secured loan can be a straightforward process if you’re prepared.

Start by determining the type of loan that fits your needs. Research lenders and compare rates, terms, and fees associated with each option.

Once you’ve selected a lender, gather necessary documentation such as proof of income, credit history, and identification. If you’re going for a secured loan, you’ll also need details about the asset you’re using as collateral.

Fill out the application form accurately to avoid delays. Many lenders offer online applications for convenience.

After submission, wait for approval which may take anywhere from hours to days depending on the lender’s policies. Be ready to answer any follow-up questions they may have during this stage.

Review your loan agreement carefully before signing to ensure it meets your expectations and understand all obligations involved moving forward.

Conclusion

When deciding between unsecured and secured loans, it’s essential to weigh your options carefully. Both types of loans have unique benefits and drawbacks that can significantly impact your financial situation.

Unsecured loans offer convenience and accessibility without requiring collateral. However, they often come with higher interest rates and stricter credit requirements. On the other hand, secured loans may provide lower rates due to the collateral involved but carry risks if you fail to make payments.

Understanding your needs—whether it’s a quick loan for unexpected expenses or a larger sum for significant investments—will guide you in making the right choice. Take time to assess your financial health, compare lenders, and consider how much risk you’re willing to take on. By doing so, you’ll be better positioned to decide which type of loan aligns with your goals while maintaining peace of mind regarding repayment terms.